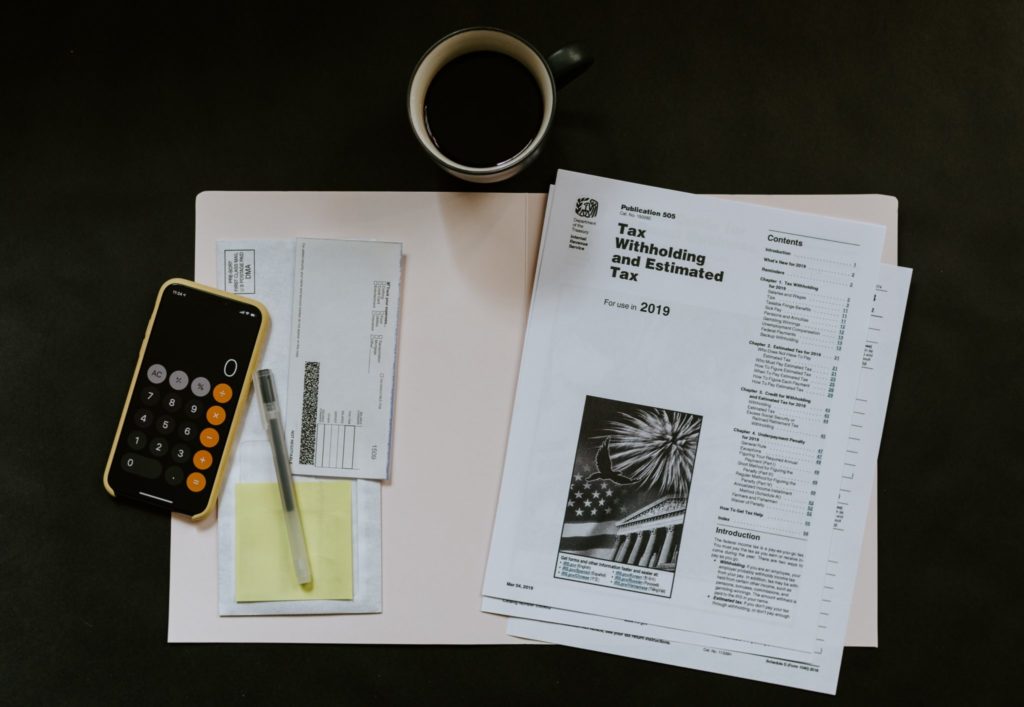

Geenen & Kolean is a CPA firm with an emphasis on taxes. We prepare premium individual and business tax returns, and strive to prepare an accurate return in an efficient and cost effective manner. We do not want you to find any surprises in the spring, which is why we offer effective tax planning throughout the year. Almost every decision you or your business makes has tax implications; tax planning can be the difference between a dreadful tax bill or a nice refund when it comes time to file your tax return.

- Income tax preparation

- Individuals, Partnerships, Corporations, Trusts, Estate

- Forecasts and projections of tax liability

- Estimate preparation for penalty avoidance

- Alternatives for minimizing tax liability

- Early withdrawal implications

- Retirement distribution implications

- Divorce and separation implications

- Representation before tax authorities